Cabo Verde Invest Obtaining a Tax number

The Número de Identificação Fiscal NIF

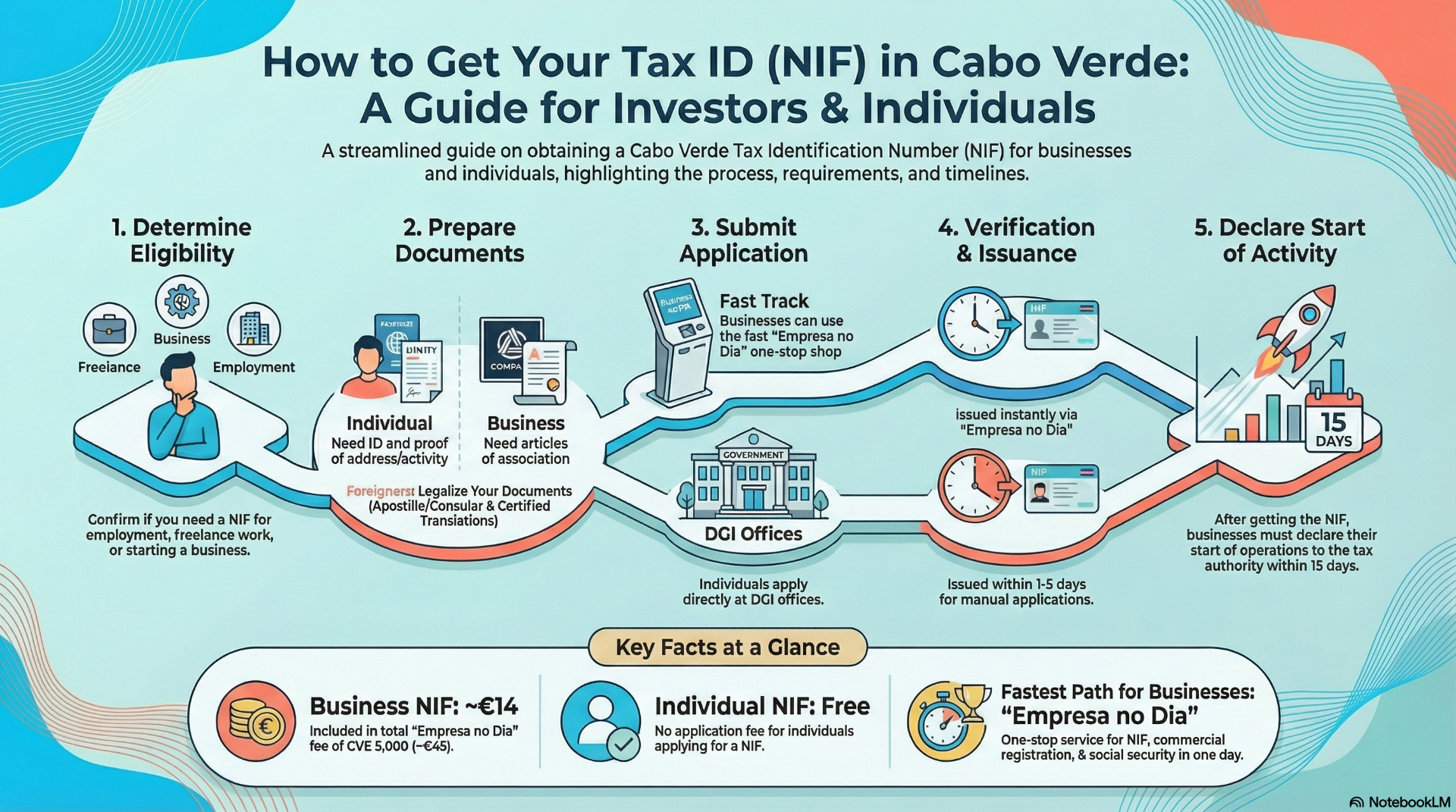

The Número de Identificação Fiscal (NIF) is a unique tax identification number issued by the Direcção-Geral dos Impostos (DGI) in Cabo Verde, essential for individuals and businesses engaging in taxable activities such as operating a company, paying taxes, or accessing government incentives.

For investors and entrepreneurs tapping into Cabo Verde's thriving sectors like tourism, renewable energy, and fisheries, obtaining a NIF is a critical step for compliance with fiscal obligations, including Corporate Income Tax (IRPC), Value Added Tax (IVA), and social security contributions.

The process is streamlined, particularly through the "Empresa no Dia" (Company in a Day) service, which integrates tax registration with commercial and social security formalities, often completing in a single day. This article outlines the procedures, requirements, costs, and practical considerations for securing a NIF in Cabo Verde as of 2025, drawing on current regulations and local practices.

Scope of the NIF

The NIF is mandatory for:

Individuals: Residents or non-residents earning income in Cabo Verde (e.g., wages, freelance work, or investments).

Businesses: All legal entities, including Limited Liability Companies (Lda), Public Limited Companies (SA), sole proprietorships, and branches of foreign companies, regardless of size or sector.

Special Cases: Non-residents conducting taxable activities (e.g., providing services or selling goods) require a NIF, even without a permanent establishment.

The NIF facilitates compliance with taxes like IRPC (21% on corporate profits), IVA (15% on goods/services), and social security contributions (24.5% total, split between employer and employee). It's also required for accessing incentives under the Investment Code, such as tax credits for tourism or renewable energy projects.

Procedures for Obtaining a NIF

Cabo Verde's NIF issuance is efficient, especially via the "Empresa no Dia" service, available at Banco Nacional Ultramarino (BNU) branches on islands like Santiago, São Vicente, Sal, Boa Vista, and Fogo. For individuals or manual business registrations, the process is handled directly by the DGI or Casa do Cidadão offices. Below is a step-by-step guide:

Determine Eligibility and Purpose

Confirm whether you need a NIF as an individual (e.g., for employment or freelance income) or a business (e.g., for a startup in Praia's digital hub). Businesses using "Empresa no Dia" receive the NIF automatically during incorporation.Requirements: Valid identification (passport for foreigners, ID for locals); proof of taxable activity (e.g., business plan or employment contract).

Timeline: Immediate for eligibility check.Prepare Required Documents

Gather documents based on your status:Individuals: Passport/ID, proof of address (e.g., utility bill or lease), and proof of taxable activity (e.g., employment contract or service agreement).

Businesses: Articles of Association, company name certificate (from INCV), proof of address for headquarters (e.g., lease in Mindelo for fisheries), and founder IDs. Foreign documents require apostille or consular legalization.

Non-Residents: Additional proof of legal entry (visa/residence permit) or activity (e.g., service contract for a consultancy in Sal).

Timeline: 1-3 days for document preparation.

Notes: Translations to Portuguese may be needed; use certified translators in Praia or São Vicente.Submit Application

Via "Empresa no Dia": For businesses, submit documents at a BNU Balcão Único, where the NIF is issued alongside commercial and INPS registration. Access the portal (empresanodia.cv) to pre-fill forms.

Directly at DGI/Casa do Cidadão: Individuals or businesses opting for manual registration visit a DGI office (e.g., in Praia) or Casa do Cidadão. Online submission is expanding but requires in-person verification.

Requirements: Complete application form (available online or at offices), all documents, and proof of legal status for foreigners.

Timeline: 1 day via "Empresa no Dia"; 1-5 days for manual submission.Verification and Issuance

The DGI verifies documents for accuracy and compliance. For "Empresa no Dia," this happens same-day, with the NIF issued instantly upon approval. Manual applications may involve a brief review, especially for non-residents or complex entities like foreign branches.Timeline: Immediate via one-stop; 1-3 days otherwise.

Cost: CVE 1,500 (~€14) for businesses (included in "Empresa no Dia" fee of CVE 5,000); free for individuals.Declare Start of Activity

After receiving the NIF, businesses must declare the start of activities to the DGI within 15 days of operations, specifying the sector (e.g., CAE code for tourism or renewables). Individuals declare when filing initial taxes (e.g., IRPS for income).Requirements: NIF, registration certificate (for businesses), and activity details.

Timeline: 1-2 days.

Cost: Free or nominal.

Practical Considerations for Investors

Streamlined Process: Use "Empresa no Dia" for businesses to save time, especially for startups in tourism-heavy islands like Sal or Boa Vista. BNU branches in Praia and Mindelo are efficient hubs.

Compliance: The NIF is linked to all tax filings (e.g., monthly IVA, annual IRPC by April 30th). Non-compliance risks fines or audits by the DGI.

Incentives: A NIF is required to apply for tax credits or IVA exemptions under the Investment Code, particularly for renewable energy projects targeting Cabo Verde's 50% renewable goal by 2030. Contact Pro-Empresa for guidance.

Challenges: Portuguese-language forms and legalization requirements may necessitate local support. Firms in Praia or São Vicente offer translation and notarization services.

Digital Tools: The DGI portal (www.financas.gov.cv) provides forms and NIF verification, with e-filing options growing in urban centers. The empresanodia.cv portal is user-friendly for pre-registration.

Non-Residents: Ensure all foreign documents are legalized; engage a local agent (e.g., via Casa do Cidadão) if not physically present.

summary

Obtaining a NIF in Cabo Verde is a straightforward process, bolstered by the "Empresa no Dia" initiative, which integrates tax registration into a single day for businesses. Whether launching a boutique hotel in Sal, a renewable energy venture in Fogo, or freelancing in Praia, the NIF unlocks compliance and access to Cabo Verde's investor-friendly fiscal system. For seamless navigation, leverage one-stop shops, prepare legalized documents, and consult Pro-Empresa for incentives. Visit www.financas.gov.cv or a local DGI office for the latest updates and support.

Costs and Timelines for Obtaining a NIF in Cabo Verde

The process of obtaining a Número de Identificação Fiscal (NIF) in Cabo Verde is efficient, particularly through the "Empresa no Dia" (Company in a Day) service, which integrates tax registration with commercial and social security formalities. Below, we outline the costs and timelines associated with each step of the process, based on 2025 regulations, for individuals and businesses seeking to comply with tax obligations or access incentives in the archipelago.

Document Preparation

Cost: Variable, between CVE 5,000 and CVE 15,000 (~€45-135) for notarization and certified translations.

Timeline: 1 to 3 days.

Details: Includes costs for notary services (e.g., in Praia or São Vicente) for document legalization and translations into Portuguese, especially for foreign investors. Apostille or consular legalization may add CVE 2,000 to CVE 10,000 (~€18-90), depending on the country of origin.

NIF Application (Businesses)

Cost: CVE 1,500 (~€14), included in the total CVE 5,000 (~€45) "Empresa no Dia" fee.

Timeline: 1 day (via One-Stop Shop); 1 to 5 days (manual process).

Details: The "Empresa no Dia" service, available on islands like Santiago, Sal, and São Vicente, issues the NIF instantly alongside commercial registration. The manual process, through the Direcção-Geral dos Impostos (DGI), takes slightly longer.

NIF Application (Individuals)

Cost: Free.

Timeline: 1 to 3 days.

Details: Individuals apply for the NIF directly at DGI offices or Casa do Cidadão, with quick verification of documents such as a passport and proof of address.

Declaration of Activity Start

Cost: Free.

Timeline: 1 to 2 days.

Details: Businesses must declare the start of activities to the DGI within 15 days of commencing operations, using the NIF and specifying the sector (e.g., tourism or renewables, per CAE codes).

Additional Costs

Legalization/Apostille: Between CVE 2,000 and CVE 10,000 (~€18-90) for foreign documents, depending on origin and complexity.

Lawyer Fees: Approximately CVE 20,000 (~€180) for complex cases, such as foreign branches or large-scale projects (e.g., renewable energy investments in Fogo).

Notes: Foreign investors should budget for these costs, particularly for regulated sectors like aviation or telecommunications, which require additional documentation.

.