本网站热烈欢迎中国用户

Cabo Verde - China cooperation

- Challenges -

The China Paradox: How Cabo Verde's Partner Became Its Rival

China helps build Cabo Verde's roads, ports and power grids. Yet the same country floods West African markets with cheap manufactured goods that directly undermine Cabo Verde's hopes of becoming a regional producer. This contradiction lies at the heart of the archipelago's economic development challenge.

Competing for the same customers

Cabo Verde wants to move beyond tourism and fishing. Government plans explicitly target light manufacturing—clothing, shoes, textiles—for export to neighbouring West African countries. A proposed "Renewable Energy Cluster" aims to produce solar panels and wind equipment for the region's 300 million consumers, transforming Cabo Verde from buyer to seller of green technology.

The problem is straightforward: China already dominates these exact sectors globally. Chinese companies produce over 80% of the world's solar panels and control wind turbine manufacturing. Between 90% and 95% of what China exports to Africa consists of finished manufactured goods, heavily concentrated in textiles and footwear—precisely what Cabo Verde wants to make and sell.

When a small island nation with limited industrial experience attempts to compete with the world's manufacturing superpower in its core strengths, the outcome is predictable. Chinese factories benefit from decades of experience, massive scale and sophisticated supply chains that Cabo Verde cannot match.

Building the gateway for competitors

Cabo Verde positions itself as a strategic hub—a stepping stone between Africa, Europe and the Americas. The São Vicente Special Maritime Economic Zone is designed as a logistics platform where Chinese ships and companies can access West African and European markets more efficiently.

This creates an uncomfortable irony. The infrastructure China builds in Cabo Verde—the ports, the warehouses, the transport links—makes it easier for Chinese manufactured goods to reach the very customers Cabo Verde hopes to serve. By becoming a gateway for Chinese commerce, Cabo Verde potentially strengthens its own competition. The better the infrastructure works, the more efficiently Chinese products flow into markets where Cabo Verdean goods might otherwise have had a chance.

.

The price war at home

What happens regionally already plays out on Cabo Verde's streets. Chinese-run shops, known locally as "lojas chinesas", sell clothing, shoes and household items at prices local merchants cannot match. Cabo Verdean business owners have complained bitterly that this unfair competition is destroying indigenous businesses. Many have closed their doors.

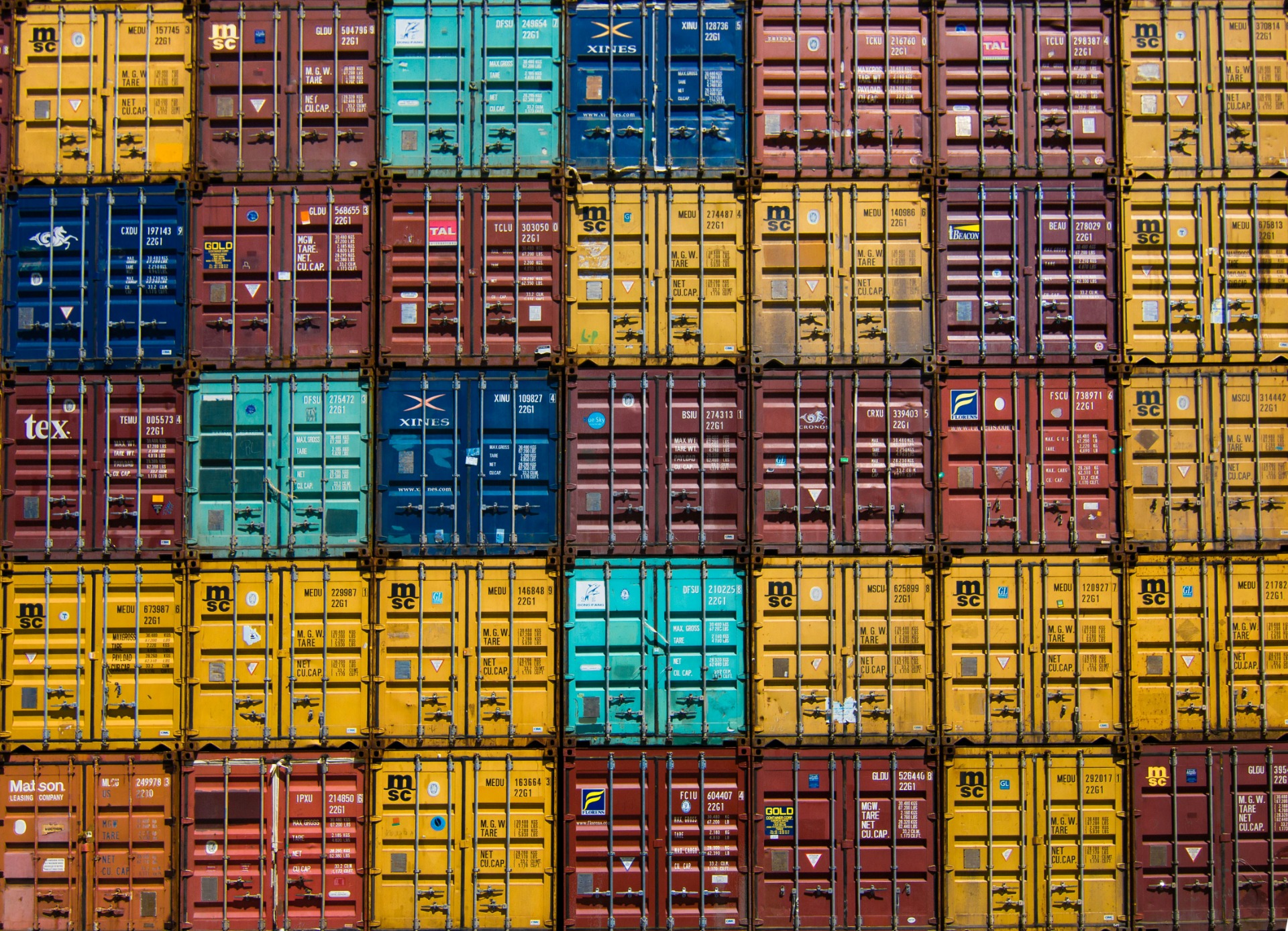

The price gap that disadvantages local shops in Praia or Mindelo operates identically across West Africa. If Cabo Verdean manufacturers cannot compete with Chinese imports in their home market where they face no shipping costs, how can they compete in Lagos or Dakar where Chinese goods arrive by the containerload?

China's overflow problem makes it worse

The competitive pressure has intensified recently due to China's domestic economic slowdown. As Chinese property development and infrastructure investment cool at home, factories face overcapacity—they can produce far more than Chinese consumers need. To keep factories running and workers employed, Chinese companies aggressively export their surplus production.

Developing countries with relatively open markets, like those in Africa, absorb much of this overflow. The result is a flood of low-cost manufactured goods that makes it nearly impossible for local African industries to take root. Countries that might have developed their own textile factories or shoe production find that by the time they are ready to start, Chinese imports have already captured the market at prices locals cannot undercut.

Locked out of regional markets

The challenge extends beyond Chinese goods entering Cabo Verde. It is about Chinese goods already dominating the markets Cabo Verde wants to sell to. West African countries trade surprisingly little with each other. Instead, they import manufactured goods from outside the continent—increasingly from China.

Evidence from East Africa shows the pattern: neighbouring countries buy more from China each year while purchasing almost nothing from each other's factories. Even if Cabo Verde develops decent production capacity, potential customers in Ghana or Senegal have already established purchasing relationships with Chinese suppliers offering lower prices. Breaking into these markets requires overcoming not just price differences but entrenched commercial relationships.

.

When partnership works

The relationship is not entirely adversarial. In some cases, Chinese investment directly helps Cabo Verde build export capacity. A Chinese state-owned company constructed a cement plant designed to transform Cabo Verde from importing cement to exporting it to nearby countries. This partnership model works because cement is heavy, expensive to transport over long distances, and requires significant capital investment that China can provide.

The difference is instructive. Heavy industry with high capital costs and transport constraints can benefit from Chinese partnership. Light manufacturing with lower barriers to entry, where Chinese companies already export globally, faces direct competition instead. Countries typically build their industrial base through textiles, clothing and simple consumer goods—exactly where China is strongest and most competitive.

The infrastructure versus industry trade-off

China builds Cabo Verde's physical infrastructure—ports, government computer systems, sports stadiums—while simultaneously dominating the markets for products Cabo Verde might make. This creates a development trap. The archipelago gets modern facilities and connectivity but struggles to develop the industries that would employ workers beyond construction and services.

For Cabo Verde to succeed in manufacturing for regional markets, it would need either products that Chinese factories do not make efficiently, markets that Chinese goods cannot easily reach, or quality and certification advantages that justify higher prices. Geographic position and European trade agreements might provide some structural advantages, but these narrow opportunities differ dramatically from the broad industrial development Cabo Verde envisions.

The uncomfortable reality is that the infrastructure China builds may prove more valuable for logistics and services than for competing with Chinese factories. While Chinese construction firms work in Praia and Mindelo, Chinese manufacturers ensure that West African shops stock Chinese textiles, Chinese electronics and Chinese household goods—blocking the development pathway Cabo Verde hoped to follow.

.