Cabo Verde - Government Finances

Government Finances: How Cape Verde Pays Its Bills

To understand the economy, you have to look at the state's wallet. Just like a household, the Government of Cape Verde has income (revenue), bills to pay (expenditure), and a credit card balance (public debt). Because Cape Verde is a small island nation with few natural resources, managing this wallet is a delicate balancing act between investing for the future and paying for today.

What the Government Spends Money On

The government's budget is generally divided into two main categories: keeping the lights on today (current expenditure) and building for tomorrow (capital expenditure).

- Salaries (The Wage Bill): This is usually the largest single expense. It pays for teachers, doctors, police officers, and public administrators. The "wage bill" consumes a massive portion of the budget—around 31% to 35% of total expenditure—and absorbs more than 40% of all tax revenue collected.

- Running the State (Goods and Services): This covers the day-to-day costs of government operations, from electricity for ministries to medicines for hospitals. This category represents about 17.9% of public spending.

- Social Support: The government spends significantly on social benefits, including pensions for retirees and the Social Inclusion Income (RSI) for the most vulnerable families. These transfers are essential for reducing poverty.

- Paying Interest: Before the government can build a new school, it must pay interest on money it borrowed in the past. In 2023, debt service (paying back loans plus interest) absorbed over 50% of central government revenue, limiting how much cash is left for other needs.

- Public Investment: This is money spent on infrastructure—building roads, expanding ports, and improving water and energy systems. While crucial for growth, this type of spending often gets cut when money is tight.

Where the Money Comes From

The government fills its wallet from three main sources:

- Taxes (The Main Source): Most of the money comes from taxes paid by businesses and citizens.

- VAT (Value Added Tax): This is a tax on consumption (what you buy at the store) and is the largest source of tax revenue.

- Income Taxes: Taxes on salaries (IRPS) and company profits (IRPC) are the next biggest contributors.

- Import Duties: Because Cape Verde imports almost everything, taxes on goods entering the country are a vital source of cash.

- Grants (Free Money): Historically, Cape Verde relied heavily on foreign aid (Official Development Assistance). While this has decreased since the country graduated to "Middle-Income" status, grants still help fund specific projects, like environmental protection or school construction.

- Loans (Borrowing): When the government spends more than it collects in taxes and grants (a fiscal deficit), it must borrow the difference. This borrowing creates public debt.

Public Debt Explained Simply

Public debt is the total amount of money the government owes to lenders.

- The Size of the Debt: During the COVID-19 pandemic, the debt shot up to over 145% of GDP because the economy shrank, and the government had to borrow to survive. Since then, it has been coming down. In 2024, public debt was estimated to be around 110% to 115% of GDP.

- Who does Cabo verde owe?

- External Debt (Foreigners): About 73-75% of the debt is owed to international creditors like the World Bank, the African Development Bank, and Portugal.

- Domestic Debt (Locals): The remaining 25-30% is owed to local banks and the social security fund (INPS) through Treasury Bonds.

Why Debt Matters (But Is Not Always Bad)

Hearing that the government owes billions can be scary, but debt is a tool. Whether it is "good" or "bad" depends on how it is used and the cost of repaying it.

- The "Good": Investing in the Future. According to economic theory, it is fair for the government to borrow to build things that will last a long time (like a port or a hospital). This is called intergenerational equity. Since future generations will use that hospital, it makes sense for them to help pay for it through future debt repayments, rather than asking today's taxpayers to pay the full cost upfront. If the debt is used for projects that make the economy grow (like tourism infrastructure), the debt essentially pays for itself over time.

- The "Bad": The Interest Trap. Debt becomes a problem when the interest payments are so high that the government can't afford to pay for basic services. When debt service eats up half of the revenue, there is very little "fiscal space" left to fix a pothole or hire a new nurse.

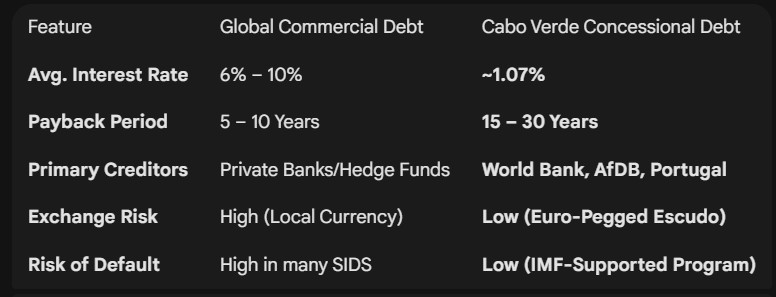

- The Cabo Verde Advantage: Fortunately, most of Cape Verde's external debt is concessional. This means it comes with very low interest rates (averaging around 1%) and very long payback periods (often over 20 years). This makes the debt much safer and easier to manage than the high-interest commercial debt faced by many other countries.

in summary

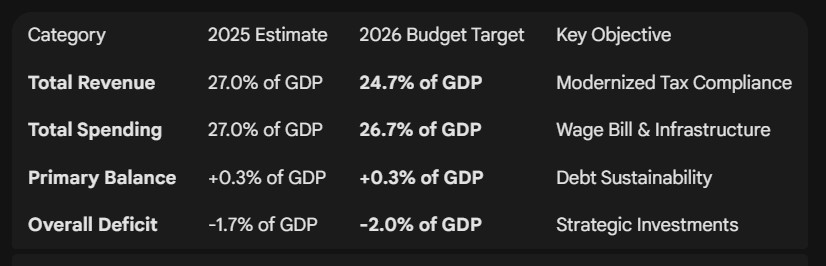

Government finance is a cycle. Taxes fund services; loans fund big investments. The current goal of the government is "fiscal consolidation"—reducing the deficit and debt—to ensure that the "credit card" bill doesn't become too heavy for future generations to carry.

Why Cabo Verde Debt is "Different"

Many investors see a debt-to-GDP ratio of 100%+ and immediately flag it as "High Risk." However, the IMF (2025) classifies Cabo Verde's debt as sustainable because of its unique structure.

Credit Rating Boost: In late 2025, Fitch Ratings maintained Cabo Verde at 'B' with a Positive Outlook, citing the government's success in reducing the debt-to-GDP ratio from 145% in 2021 to approximately 104.9% by end-2025.

Interest Rate Gap: While global interest rates remain elevated, Cabo Verde's average interest on external debt has stayed exceptionally low (around 1%), shielding the budget from the "interest trap" seen in other African nations.

The "Euro Shield": Unlike other nations whose debt costs skyrocket when their currency devalues, the Escudo-Euro peg (110.265) ensures that Cabo Verde's debt—largely held in Euros or SDRs—remains predictable and manageable.