Cabo Verde - Buying Real Estate

Buying Real Estate in Cape Verde as a Foreigner: Step-by-Step Guide

Cape Verde (also known as Cabo Verde) is an attractive destination for foreign property buyers, thanks to its stunning beaches, stable economy, and investor-friendly policies. Foreign nationals can purchase property without restrictions, including freehold ownership, in most sectors like residential, tourism, or commercial real estate. Popular spots include the islands of Sal (e.g., Santa Maria for beachfront apartments), Boa Vista (e.g., Sal Rei for villas), and Santiago (e.g., Praia for urban properties). The process is influenced by Portuguese law, making it relatively straightforward but requiring professional help to avoid pitfalls like title disputes or hidden debts.

Buying property can also qualify you for residency benefits, such as a "Green Card" (residence permit) if the investment exceeds certain thresholds (e.g., €200,000 in real estate, potentially with tax exemptions). The entire process typically takes 4-8 weeks, with total additional costs around 5-7% of the property value. Always engage an independent local lawyer early—many speak English—and consider a real estate agent for listings.

Key Prerequisites

Valid Passport: Apostilled if from non-EU countries.

Fiscal Number (NIF): A tax ID required for all transactions; obtain it via Casa do Cidadão.

Bank Account: Open one in Cape Verde for payments (e.g., at Banco Comercial do Atlântico or Caixa Económica).

Budget: Properties start at €50,000 for apartments; expect cash purchases as mortgages are rare and expensive for foreigners (rates ~7-8%). No local residency needed upfront, but post-purchase residency applications are common.

Step-by-Step Process

Appoint Professionals and Negotiate:

- Hire an independent lawyer (advogado) to represent you—essential for foreigners to verify ownership and contracts. Costs: €500-1,500.

- Negotiate price via your agent. Sign a reservation agreement to hold the property, paying a deposit (typically €3,000 or 5% of the price).

- Set up power of attorney (procuração) if you can't attend closings—done at a notary or Cape Verde embassy abroad (€60-100).

- Where to go: Lawyer directories via Judicare Group or local bar association (Ordem dos Advogados de Cabo Verde) in Praia. Casa do Cidadão balcões for initial docs like NIF (call 800 2008 for English help).

Conduct Due Diligence and Sign Promissory Contract:

- Your lawyer checks the property title at the Land Registry (Conservatória do Registo Predial), obtains a "Certidão de Teor" (title certificate), and ensures no debts (e.g., unpaid taxes or utilities).

- Sign the Promissory Purchase and Sale Contract (Contrato Promessa de Compra e Venda), outlining terms, price, and timeline. Pay the full deposit (10-30%).

- Obtain your NIF if not already done.

- Time: 1-2 weeks.

- Where to go: Land Registry offices on major islands (e.g., Praia, Mindelo on São Vicente). Notary public (Cartório Notarial) for contract signing.

Finalize Payment and Sign the Deed:

- Transfer the balance via bank (often in euros, as CVE is pegged to EUR at 110:1).

- Sign the final public deed (Escritura Pública) at a notary, transferring ownership.

- Pay transfer tax (IUP - Imposto sobre a Propriedade Urbana) at 1.5% of the property value (or higher assessed value).

- Other fees: Notary (~€420), registration (~€200-300), stamp duty (0.8%).

- Time: 3-4 weeks after promissory.

- Where to go: Notary offices island-wide (e.g., in Espargos on Sal). Banks for wired payments.

Register the Property and Complete Post-Purchase Steps:

- Your lawyer registers the deed at the Land Registry, issuing your ownership certificate.

- Pay annual property tax (IUP, 0.5-1.5% of value) via tax authorities.

- If seeking residency, apply for a residence permit or Green Card through immigration—property investment can fast-track this.

- Update utilities and, if renting, obtain a tourism license if applicable.

- Where to go: Land Registry for registration. Casa do Cidadão or Balcão Único do Investidor (BUI) at CV TradeInvest offices (Praia, Espargos, Mindelo) for residency/investment incentives. Online portal: portondenosilha.cv for digital submissions.

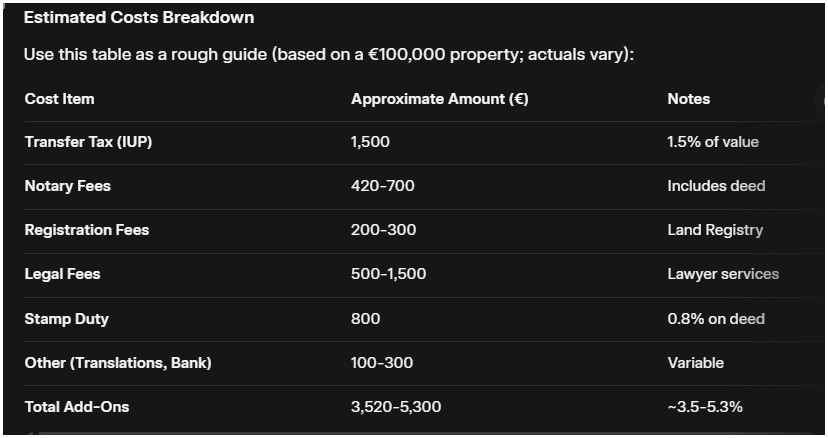

Estimated Costs Breakdown - Use this table as a rough guide (based on a €100,000 property; actuals vary):

Tips for Foreign Buyers

Avoid Risks: Cape Verde is safe for investments, but scams exist—always use verified agents and lawyers. Check for "tourism utility" status on resorts for tax perks.

Financing: Cash is king; local mortgages require 30-40% down and proof of income.

Residency Perks: Investments over €200,000 may qualify for 5-10 year tax exemptions or permanent residency—consult BUI.

Taxes on Sale: Capital gains tax (10-15%) applies if reselling; plan with your lawyer.

Language: Official is Portuguese; bring a translator or use English-speaking pros.

Current Trends (2025): Rising demand in Sal and Boa Vista due to tourism growth; prices up 10-15% yearly.

Demystify Cabo Verde's Property Tax: Essentials for Smart Foreign Buyers

Tired of tax surprises sinking your dream island investment? The Imposto Único sobre o Património (IUP) is Cabo Verde's straightforward annual property tax—often just €250-500/year on a €100K villa—designed to keep ownership simple and affordable. See more in our page >