Cabo Verde Investment Law

Cabo Verde's 2012 Investment Law offers foreign investors: equal treatment with locals, protection against expropriation with fair compensation, free profit repatriation in convertible currency, tax incentives including exemptions and credits, and electronic registration through one-stop-shop . Strategic projects qualify for Special Establishment Agreements. International arbitration available for disputes.

Investment Law in Cabo Verde: What Foreign Investors Need to Know

A modern and simplified legal framework

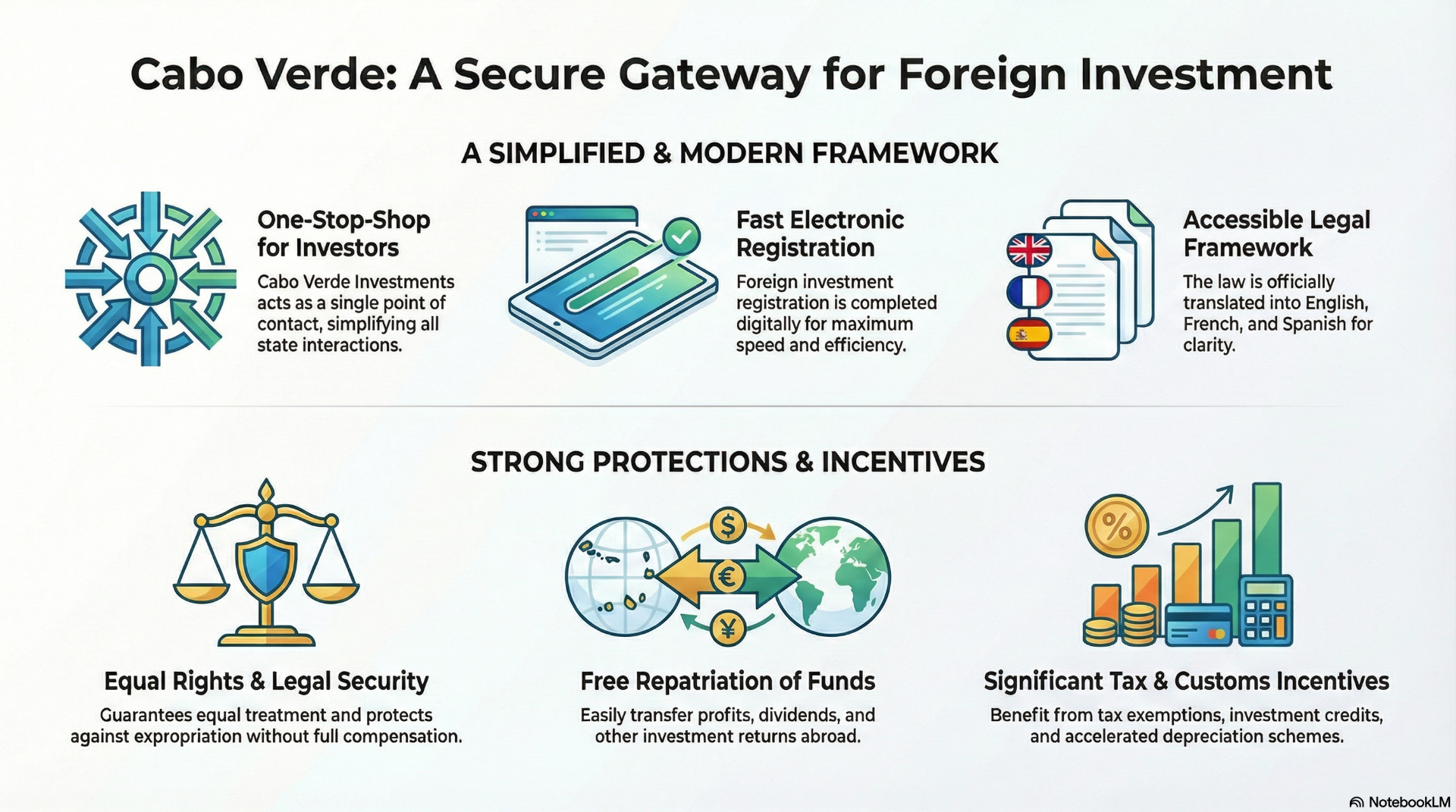

The Investment Law of Cabo Verde (Law No. 13/VIII/2012, as amended in 2013) sets the foundation for attracting and protecting investments in the country. Its main purpose is to facilitate the inflow of foreign capital, reduce bureaucracy, and provide legal certainty.

With the 2013 amendments, the process became even more agile:

-

Registration of foreign investments is now carried out electronically through Cabo Verde Investments, the day after the Investment Registration Certificate is issued;

-

Cabo Verde Investments acts as a one-stop-shop for investors, simplifying all State interactions;

-

The law has been translated into English, French, and Spanish, ensuring accessibility for international investors.

Rights and guarantees for investors

One of the law's strongest features is its legal protection for foreign investors:

-

Equal treatment: both local and foreign investors enjoy the same rights and obligations;

-

Protection against expropriation or nationalization, except in cases of public interest, with full and fair compensation;

-

Right to transfer profits and dividends abroad in freely convertible currency, provided the investment is duly registered;

-

Possibility to hold foreign currency accounts in local banks;

-

Confidentiality of all information submitted during the investment process.

Investment incentives

Projects carried out under the Investment Law can benefit from a range of tax and customs incentives, such as:

-

Tax exemptions or reductions;

-

Tax credits for investment;

-

Accelerated amortization and depreciation;

-

Automatic or contractual incentives, depending on the scale and nature of the project.

Large or strategic projects may qualify for a Special Establishment Agreement with the State, securing additional guarantees and support.

Transfer of funds and profits

The law provides strong financial security for foreign investors:

-

Profits, dividends, royalties, and other returns can be freely repatriated;

-

The Central Bank of Cabo Verde must authorize transfers within 30 days;

-

In exceptional cases, transfers may be staggered, but never for more than two years;

-

Foreign workers employed by companies with foreign capital may also transfer their salaries abroad.

Dispute resolution

The law ensures international mechanisms for investor protection:

-

Disputes may be resolved through international arbitration (including ICSID – International Centre for Settlement of Investment Disputes, or the ICC – International Chamber of Commerce in Paris);

-

Cabo Verdean courts also remain an option, if both parties agree.

Strategic sectors and objectives

Investments are expected to contribute to:

-

Job creation and workforce training;

-

Diversification of exports and reduced external dependence;

-

Strengthening the national economy and modernizing infrastructure;

-

Environmental balance and promotion of technological innovation.

summary

With its Investment Law, Cabo Verde offers a transparent, competitive, and investor-friendly business environment, characterized by:

-

Simplified and digitalized registration process;

-

Strong guarantees for capital repatriation;

-

Clear tax incentives under the Tax Benefits Code;

-

Robust legal protection against discrimination and expropriation.

For foreign investors, this means confidence and predictability — two key factors for medium and long-term investment decisions.