Social Security and Employer Obligations in Cabo Verde

The Cost of Hiring: Social Security and Employer Obligations in Cabo Verde

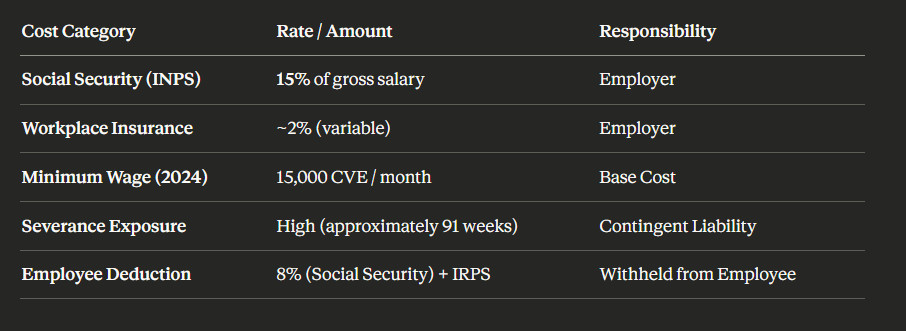

For investors analyzing the Cabo Verdean labor market, understanding the non-wage labor costs is as important as understanding base salaries. The system is centralized under the National Social Security Institute (INPS) (Instituto Nacional de Previdência Social), which manages a mandatory contributory program for all employed workers. While the tax burden is moderate, investors must factor in relatively high unit labor costs and specific restrictions regarding termination.

1. Social Security Contributions (The "TSU")

The social security system covers sickness, maternity, workplace accidents, disability, old age (pensions), and death. Enrollment in the INPS is mandatory for all workers in the formal sector.

The total contribution rate is 23.0% of the employee's gross monthly salary. This cost is shared between the employer and the employee, with the employer paying the larger portion.

Contribution Breakdown

Component Employer Share Employee Share Total

Social Security (INPS) 15.0% 8.0% 23.0%

Allocation of Funds: The 23% total contribution is divided into specific social programs as follows:

- Pensions: 10% (Employer pays 7%; Employee pays 3%).

- Sickness & Maternity: 8% (Split equally 4% / 4%).

- Family Allowance: 3% (Fully paid by the Employer).

- Administration: 2% (Split equally 1% / 1%).

2. Additional Employer Costs and Insurance

Beyond the mandatory 15% social security contribution, employers are responsible for specific insurance coverage and administrative costs.

- Workplace Accident Insurance: Employers are required to provide insurance against workplace accidents and occupational diseases. Historical estimates suggest that total non-wage labor costs (Social Security + Insurance) amount to approximately 17% of the salary.

- Firing Costs: Investors should note that redundancy and severance costs in Cabo Verde have historically been high compared to similar countries. The "firing cost" has been estimated at approximately 91 weeks of salary in past regulatory assessments, contributing to a "difficulty of firing" index of 70 (on a scale of 0–100). This rigidity makes dismissing permanent workers expensive and administratively complex.

3. Wage Structure and Minimum Wage (2024–2025)

While labor productivity in Cabo Verde is relatively high compared to some lower-middle-income countries, labor costs are also elevated.

- Minimum Wage Updates:

- 2024: The national minimum wage was updated to 15,000 CVE (approximately €136) for the private sector and 16,000 CVE (approximately €145) for the public sector.

- Future Targets: Under the "Strategic Concertation Agreement 2024–2026," the government and social partners aim to increase the minimum wage to 17,000 CVE in 2025, with a target of reaching 19,000–20,000 CVE by 2027.

- Unit Labor Costs: Historical analysis shows that unit labor costs (labor costs relative to productivity) in Cabo Verde are high. In manufacturing, for example, unit labor costs have been estimated at 49% of value added, which is higher than in competitor nations like Mauritius or South Africa.

- Wage Premiums: There's a significant wage premium for skilled labor. Workers with university education or specific technical skills command significantly higher wages due to a shortage of specialized human capital.

4. Income Tax (IRPS) Withholding

While not a direct cost to the employer, companies must withhold Personal Income Tax (IRPS) from employee salaries. The tax system is progressive. As of recent budget laws:

- Exemption Threshold: Annual income up to 220,000 CVE is generally exempt.

- Withholding Rates: For 2024, specific withholding rates were applied to different salary brackets (e.g., 2.8% for salaries up to 33,000 CVE; 2.0% for salaries between 33,000 and 51,000 CVE) to manage inflationary pressure.

5. The Challenge of Informality

A significant portion of the Cabo Verdean labor market operates outside the formal social security system.

- Informality Rates: Estimates suggest that between 48.7% and 53.8% of the employed population works in the informal sector.

- Impact: This high level of informality means that roughly half the workforce doesn't contribute to or benefit from INPS coverage, creating a disparity between formal businesses (which bear the full 23% cost) and informal competitors. The government is actively pursuing policies to accelerate the transition from the informal to the formal economy to broaden the contribution base.

Investors are advised to consult with local legal counsel or the General Directorate of Labor (DGT) (Direção Geral do Trabalho) to confirm specific sector-based collective bargaining agreements that may influence these baseline costs.

Cabo Verde Social Security and Employer Obligations in Cabo Verde

Enter your text here...

Cabo Verde Social Security and Employer Obligations in Cabo Verde

Enter your text here...

Cabo Verde Social Security and Employer Obligations in Cabo Verde

Enter your text here...

Cabo Verde Social Security and Employer Obligations in Cabo Verde

Enter your text here...