本网站热烈欢迎中国用户

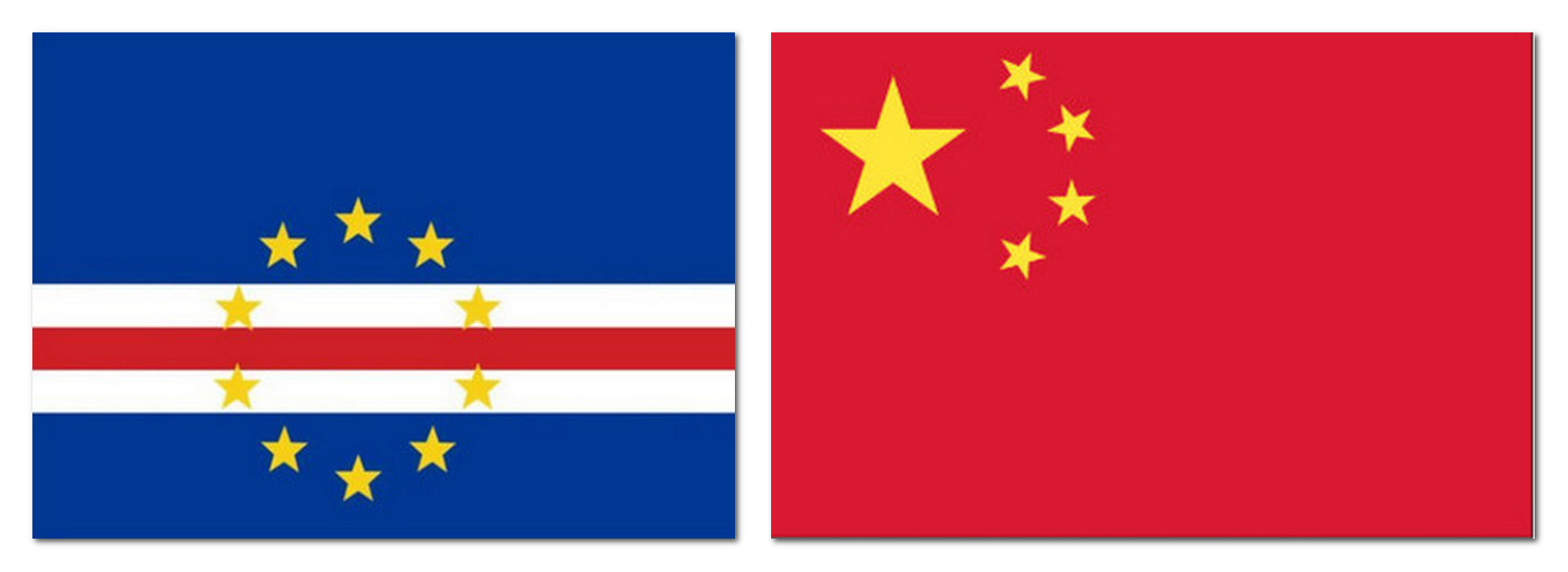

The economic relationship between Cabo Verde and China

The Dragon and the Archipelago: An Analysis of China-Cabo Verde Trade Relations

As Cabo Verde and the People's Republic of China approach the 50th anniversary of their diplomatic relations in 2026, their economic partnership has matured into a critical, albeit structurally imbalanced, engagement. China has solidified its position as one of Cabo Verde's most important economic partners, serving not only as a primary source of imports but also as a crucial financier of national development.

In 2024, bilateral relations were elevated to a Strategic Partnership, signaling a intent to deepen economic ties beyond traditional aid and construction. However, the commercial relationship remains defined by a significant trade deficit and a heavy reliance on Chinese industrial goods.

Trade Volume: A Trajectory of Growth

Bilateral trade between the two nations has shown consistent growth in recent years, reflecting China's expanding commercial footprint in the archipelago.

- 2024 Performance: The bilateral trade volume reached approximately $114 million in 2024. This represented a 10.3% increase compared to the previous year.

- 2023 Performance: In 2023, the trade volume was recorded at $103 million, which itself was a year-on-year increase of 15.2%.

These figures highlight a steady upward trend, contributing to a trade relationship that has grown twentyfold since the establishment of the Forum Macao in 2003.

The Structural Deficit: A One-Way Street?

Despite the growing volume, the commercial relationship is characterized by a profound structural imbalance. China is a dominant supplier, while Cabo Verde's footprint in the Chinese market remains microscopic.

1. China as a Key Supplier China is a top source of imports for Cabo Verde, accounting for roughly 8% of the country's total imports in 2022. The composition of these imports reflects Cabo Verde's reliance on Chinese manufacturing to support its service-based economy and infrastructure development. Key import categories include:

- Vehicles and Machinery: Vehicles, electrical equipment, and machinery constitute a significant portion of imports, supporting local transportation and construction sectors.

- Consumer Goods: Chinese merchants have established a strong presence in Cabo Verde's retail sector, selling affordable clothing, footwear, and household items. These low-cost goods have been credited with increasing the purchasing power of the local population.

- Construction Materials: Ceramic products, iron, and steel are heavily imported to fuel Cabo Verde's tourism and real estate construction projects.

The Export Challenge

Conversely, Cabo Verdean exports to China remain modest. In 2022, for example, while imports from China reached nearly $93 million, exports to China were recorded at a mere $20,000.

Cabo Verde's export base is narrow, consisting largely of niche products like canned fish and raw materials. While processed fish and crustaceans are Cabo Verde's primary global export, the volume reaching the Chinese market is currently low. However, expanding access for these products is a central goal of current diplomatic engagements. To address this, China has implemented measures to facilitate imports from African countries, including creating a "green channel" for African agricultural exports and offering zero-tariff treatment for a vast majority of tariff lines.

Financing and Diversification: Bridging the Gap

Recognizing that trade alone cannot balance the economic relationship, cooperation has expanded into financing and investment aimed at diversifying Cabo Verde's export base.

- Strategic Financing: Since trade revenue is insufficient, China remains a primary source of financing. In January 2025, the two nations signed a cooperation agreement worth approximately $28.5 million (200 million RMB) to fund projects in key sectors like the digital economy and renewable energy.

- Diversification Efforts: Efforts are underway to diversify the economy beyond tourism and simple commerce. The São Vicente Special Maritime Economic Zone (ZEEMSV), planned with Chinese technical support, aims to transform the island into a logistics platform for fish processing and exports, potentially boosting Cabo Verde's capacity to sell to global markets, including China. Additionally, investments in the digital economy and renewable energy (targeting 50% renewable production by 2030) are being prioritized to reduce reliance on imported fossil fuels and create high-value services that could eventually narrow the economic gap.

Summary

The economic relationship between Cabo Verde and China is a lifeline for the archipelago, providing essential affordable goods and critical infrastructure financing. However, the trade balance remains heavily skewed in China's favor. The future of this partnership depends on successfully leveraging Chinese investment to build Cabo Verde's productive capacities—particularly in the blue economy and digital services—transforming the nation from a consumer of Chinese goods into a strategic Atlantic hub.