The Transportation Challenge for Businesses in Cabo Verde

Cabo Verde's inter-island transport system

For any business operating in Cabo Verde, understanding the country's inter-island transport system is essential. The archipelago consists of nine inhabited islands spread across the Atlantic, and reliably moving goods, employees, and customers between them remains one of the economy's biggest bottlenecks. Whether you're running a tourism operation, managing supply chains, or coordinating staff across multiple locations, Cabo Verde's fragmented and unreliable transport network will directly impact your operations.

The Geographic Challenge

Cabo Verde's scattered island geography makes inter-island connectivity not just convenient but absolutely essential for economic integration. The country has ten islands (nine inhabited), with major economic centers distributed across different islands: Praia (the capital) on Santiago, Mindelo on São Vicente, and the tourism hubs of Sal and Boa Vista. Moving people and goods between these islands requires either air or maritime transport—there's no alternative.

Maritime Transport: The Lifeline with Serious Problems

Maritime transport serves as Cabo Verde's essential lifeline, handling both cargo and passengers through a network of nine ports. However, the system is characterized by unreliability, outdated vessels, and chronic delays that complicate business planning.

The Numbers

The scale of maritime activity is substantial:

- Total cargo throughput: Approximately 2.5 million tons annually (pre-pandemic)

- Cabotage (domestic inter-island cargo): Represented 38% of total cargo initially, but surged to 49% by 2022—approximately 1 million tons annually

- Passenger traffic: Grew substantially by 40% from 932,775 in 2018 to 1,302,798 in 2022

- Main cargo hubs: Porto da Praia (Santiago) and Porto Grande (São Vicente) jointly account for 70% of all cargo throughput

For tourism-centered islands, domestic shipping is critical: cabotage accounts for 47% of total cargo on Sal and 69% on Boa Vista—meaning these islands depend heavily on reliable inter-island shipping to receive goods.

The CV Interilhas Concession: A Struggling System

In 2019, the government granted a 20-year concession to CV Interilhas (CVI), a consortium of domestic and Portuguese operators, to manage the nationwide Roll-on Roll-off (Ro-Ro) network. CVI is the only authorized passenger service provider, though cargo shipping faces competitive pricing.

The concession's performance has been disappointing:

- Fleet condition: The contract stipulates five Ro-Pax vessels, but CVI operates four Ro-Pax and two conventional vessels—all considered old, outdated, and unreliable

- Chronic delays: Over 50% of port arrivals experienced delays of 3-6 hours in Q1 2023 (excluding the São Vicente-Santo Antão route)

- Limited frequency: Most routes offer only 2 weekly services between major island groups, with some routes operating only fortnightly

- Government subsidies: The concession requires state support capped at approximately US$7 million annually due to operational inefficiencies and price caps

Current Crisis

As of November 2025, a maritime transport crisis has severely impacted islands like Brava, with the concessionaire condemned for serious failings affecting commerce, tourism, and local populations. Ship breakdowns are frequent, often without backup options, leaving islands isolated for extended periods.

Market Restrictions

To protect the CVI concession, the Maritime and Port Institute (IMP) halted issuing new operating licenses in 2019, preventing new operators from entering the passenger market. However, two non-concession cargo carriers continue operating successfully, trans-shipping international cargo to tourism islands—demonstrating that private operators can serve the cargo market effectively without subsidies.

The exception is the heavily-trafficked São Vicente-Santo Antão route (approximately 300,000 trips yearly), where two private companies—Nosferry and Polaris—were authorized in March 2022 and now hold 58% market share with four daily trips.

What This Means for Business

If your business depends on moving goods between islands—particularly perishable products or tourism supplies—expect:

- Unreliable scheduling with frequent multi-hour delays

- Limited service frequency requiring advance planning

- Higher logistics costs due to inefficiencies

- Particular challenges serving smaller islands (Maio, Brava, São Nicolau moved only 4% of domestic cargo in 2014)

The unreliable maritime transport severely complicates connecting local food producers (mainly on Santiago, Santo Antão, and Fogo) with hotel demand in Sal and Boa Vista, hindering integration of fresh domestic products into the tourism value chain.

Domestic Air Transport: A Turbulent History

Domestic air connectivity has experienced even more dramatic disruptions, with the market shifting between operators and experiencing extended service suspensions.

The Evolution of Domestic Service

- Pre-2017: State-owned TACV (Cabo Verde Airlines) held 100% of the domestic market

- 2016-2021: Spanish airline Binter Canarias (later TICV) took over when TACV discontinued domestic operations

- 2021-2024: Angolan airline BestFly acquired Binter's 70% stake (government retained 30%) and rebranded as BestFly Cabo Verde

- April 2024: BestFly suspended all operations, citing ACMI (Aircraft, Crew, Maintenance, and Insurance) operational issues

The Crisis

BestFly's limited fleet—just one to two ATR aircraft—could never meet pre-pandemic frequency of 93 weekly flights. The airline briefly suspended most flights in mid-2023, then completely ceased operations from April 19, 2024, and has not resumed service.

The impact was severe:

- Seat offerings declined over 60% in 2021 and 37% in 2022 compared to pre-pandemic levels

- Low frequency meant only three routes from Praia offered multiple daily flights on certain days (São Vicente, Sal, São Felipe)

- Other islands like Maio, São Nicolau, and Boa Vista became accessible only a few days per week

- Operational issues frequently caused delays and cancellations—sometimes affecting 18 flights in a single day with rescheduling delays up to 12 hours

Current Status: TACV Returns and LACV Creation

Following BestFly's exit, the renationalized TACV (Cabo Verde Airlines) returned to covering domestic flights in early 2024. Additionally, authorities created a new domestic airline—Linhas Aéreas de Cabo Verde (LACV)—to enhance inter-island connectivity, though operationalization is ongoing.

The national carrier implemented creative hybrid solutions, even using small cargo and passenger ferries for expedited island-to-island dispatches when ATR 72-500 aircraft (the backbone of inter-island travel) were grounded.

The TACV Fiscal Burden

TACV's return to domestic service comes with significant costs:

- Consecutive losses requiring heavy state support

- Total debt of US$58.1 million (3.3% of GDP) plus arrears of US$17.8 million (1% of GDP) in 2021

- Annual cash needs projected between US$47 million to US$105 million without operational improvements

- 2019 load factor of only 59.8%, well below African average (71.7%) and global average (83%)

Why Private Airlines Struggle

Rigid price controls and limits discourage other airlines from entering the market, making it unlikely that service levels will return to pre-pandemic standards. The government's 30% stake in the domestic operator and price caps create an environment where private operators cannot operate profitably.

Transport Infrastructure

While operational services struggle, infrastructure development shows more promise:

Airports

Cabo Verde has four international airports (Santiago, São Vicente, Sal, Boa Vista) and three domestic aerodromes (São Nicolau, Fogo, Maio). Brava and Santo Antão lack airport infrastructure.

In 2022, the government signed a 40-year concession with Vinci Airports and Aeroportos de Portugal, who became operators in July 2023 after paying an upfront fee of US$35 million. This professional management should improve airport efficiency.

Ports

Major port infrastructure investments are underway:

- The EU Global Gateway initiative committed €246 million covering expansion of Maio, Palmeiras, and Porto Grande ports

- Porto Grande (São Vicente) is the only port with refrigerated warehousing capacity—6,000 tons for fish and perishables

- Port concession process (ENAPOR) is in final stages, with sub-concession contract anticipated for Q3 2025

Strategic Implications for Business

Cabo Verde aims to become an International Business Platform and Atlantic Aviation Hub, centered on Sal Island. However, the poor quality, cost, and frequency of inter-island transport remain fundamental obstacles to economic unity and competitiveness.

Practical Considerations

When planning operations in Cabo Verde:

- Expect logistics challenges: Build extra time into supply chains for delays and cancellations

- Focus operations: Consider concentrating on single islands (Santiago, Sal, or Boa Vista) rather than multi-island operations

- Plan for self-sufficiency: Unreliable transport may require maintaining larger inventories

- Avoid perishables: Unless operating on production islands, fresh local products face major distribution challenges

- Budget for air freight: When maritime service fails, expensive air alternatives may be necessary

- Monitor reforms: The port and airport concessions may improve reliability over time

The inter-island transport challenge represents Cabo Verde's single biggest economic bottleneck. While infrastructure improvements are underway, operational reliability remains poor. Businesses must plan accordingly, recognizing that the archipelago's geography—combined with struggling transport operators—will complicate logistics far more than in continental countries. Success in Cabo Verde requires building operational resilience into your business model from day one.

Facts & Figures

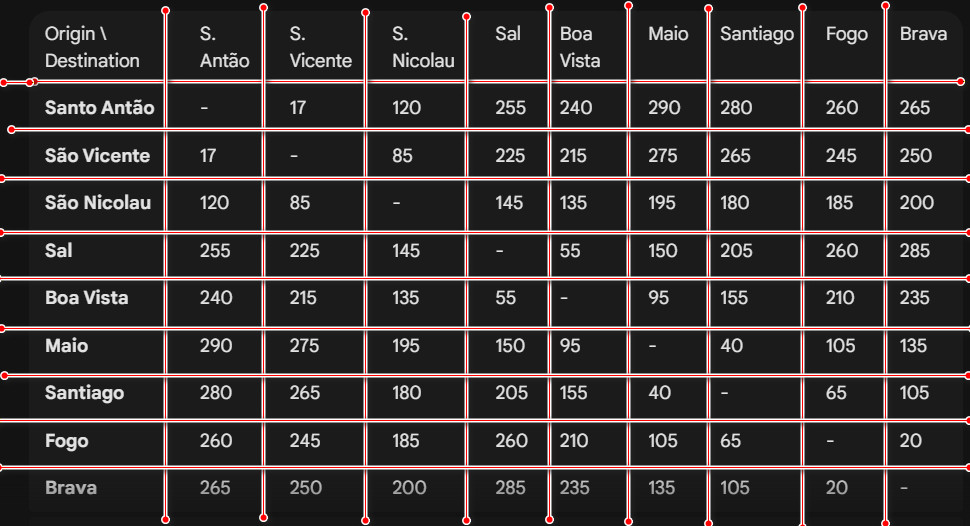

Inter-Island Distances Matrix (in km)